The Economics of Retention: Why Most D2C Brands Don’t Have an Acquisition Problem

A GrowthLens teardown of what truly drives or destroys D2C performance.

Most D2C brands are not held back by acquisition. They are held back by economics they have not yet confronted. You can scale spend, improve creatives and expand channels, but if retention is weak, the business is running uphill with a weighted vest. The revenue line grows, but the system underneath becomes more fragile. Growth feels fast, but the economics drift out of alignment and scale exposes the gap

The brands that scale predictably are the ones that learn a simple truth early: acquisition creates volume, but retention creates power.

Why Retention Is the Invisible Economic Leak

Revenue can grow while the business becomes weaker underneath. Across the D2C audits I’ve run, I’ve repeatedly seen seventy to ninety percent of revenue coming from first-time buyers. On paper, acquisition looks healthy. In reality, the model restarts every month.

Weak retention quietly breaks the core economics of a D2C brand:

-

CAC pressure rises as audiences saturate

-

Payback windows stretch beyond the 6–9 month healthy range

-

Marginal CAC surges 30–50 percent at scale

-

Reinvestment speed slows as cash cycles extend

-

Contribution margins compress under rising acquisition costs

-

Cash cycle stability disappears as repeat revenue weakens

These are not campaign problems. They are P&L problems

The Myth: “We Need More Acquisition

When growth slows, teams often respond by increasing ad spend. It rarely fixes the core issue.

Across the D2C brands I’ve audited, acquisition cannot compensate for weak retention because:

-

New cohorts get progressively more expensive as audiences saturate

-

Revenue relies on reacquiring the same buyer pool every month

-

AOV improves but LTV stays flat, capping CAC tolerance

-

Cash returns slower, reducing how fast spend can scale

-

Marginal CAC rises 30–50 percent at every spend increase

You don’t fix a leaky bucket by pouring more water in. You fix the leak.

The Retention-Economics Framework

You don’t need dozens of dashboards. A few core signals tell the story quickly:

Revenue Mix

If more than seventy percent of revenue comes from first-time buyers, you’re running on reacquisition, not retention. Across audits, brands that shift early cohorts toward thirty to forty percent repeat revenue consistently see stronger cash flow and faster LTV unlock.

Cohort Curves

Healthy curves show progression beyond the first and second purchase. When cohorts flatten after purchase two, you are not building a compounding customer base. Strong curves show a clear step-up by the third transaction, which correlates with faster CAC recovery.

Payback Windows

A six to nine month payback already strains cash in most D2C categories. Beyond twelve months, scaling becomes mathematically difficult. Brands with sub-six-month payback reinvest with confidence because the cash cycle supports growth.

Marginal CAC

If CAC rises faster than contribution margin as you scale, growth gets harder each quarter. This is one of the earliest signs of reacquisition dependence.

Cash Cycles

Cash cycles longer than ninety days slow reinvestment velocity even if topline performance looks healthy.

Signature Insight:

Before thinking about channels, creatives or funnels, a D2C brand must first become cash-fit: where retention returns capital quickly enough to fund growth without destabilising the model. Cash-fit brands scale calmly; brands that are not cash-fit scale anxiously.

Operator Rule:

If marginal CAC rises faster than retention improves, the business is already moving in the wrong direction.

Real-World Signals from D2C Audits

Pattern 1: Second-Purchase Threshold

Across audits, brands with less than twenty percent repeat purchase in the first sixty to ninety days show clear cohort decay and slower CAC recovery. Brands crossing thirty percent second-purchase progression in the same window demonstrate materially stronger LTV trajectories.

Pattern 2: Time-to-Second-Purchase

When time-to-second-purchase exceeds forty-five days, retention curves weaken almost universally. Shorter windows consistently drive higher purchase frequency, stronger LTV and more resilient payback.

Pattern 3: Revenue Mix Warning

A mix of seventy to ninety percent new-customer revenue with ROAS below one (even with strong creatives) is the classic reacquisition trap. Strong margins often mask the fragility underneath.

The Signal:

These metrics don’t stand alone. They are interconnected symptoms of retention economics breaking down.

Reacquisition Dependence: When Acquisition Turns Into a Liability

Reacquisition dependence is the point where acquisition stops driving growth and starts weakening the economics. I have seen this pattern across multiple brands. In more than one audit, the founder said “retention is not our priority” at the exact moment scale was tightening and CAC had already begun to rise. The data always surfaced the tension before the team did.

Symptom 1: Marginal CAC Rises at Every Scale Step

When paid channels are responsible for refilling the entire revenue base each month, marginal CAC increases. You start paying more to acquire the same customer profile because nothing compounds. At scale, this rise is often thirty to fifty percent.

Symptom 2: Payback Drifts Outward Quietly

A six to nine month payback already strains cash in most D2C models. Weak retention pushes payback beyond twelve months long before the impact is obvious. Cash returns slower than expected and reinvestment becomes harder.

Symptom 3: Cash Cycles Stretch Beyond Ninety Days

If repeat revenue does not catch up before CAC comes due, the business falls behind the cash cycle. Teams shift from growth budgeting to defensive budgeting. Acquisition planning becomes reactive, not strategic.

High margins can mask these issues temporarily. But the moment acquisition plateaus or competition intensifies, the underlying economics reveal themselves quickly.

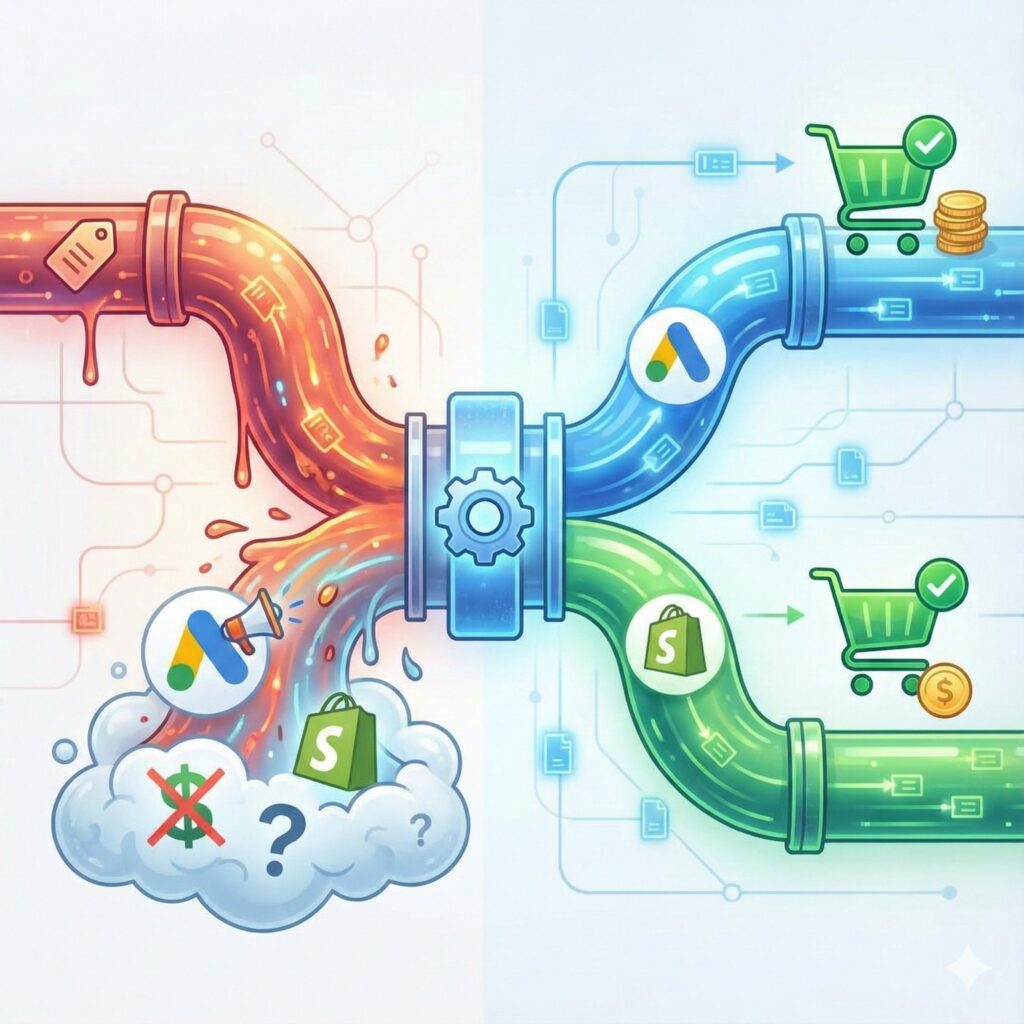

The Flywheel That Actually Scales

Retention isn’t a CRM function. It is an economic engine.

Repeat Purchases → Higher LTV → Greater CAC Tolerance → Scaled Acquisition → More Repeats

How the flywheel compounds:

-

Repeat behaviour drives LTV 3-5x higher than one-time buyers.

-

Higher LTV lets brands bid 2-3x more aggressively on Meta and Google.

-

Greater CAC tolerance allows scale without payback stress.

-

Scaled acquisition brings more customers into the repeat loop.

-

Momentum builds as retention strengthens, creating durable growth rather than fragile volume.

The difference:

Weak retention forces the business to restart every month. Strong retention creates a compounding flywheel.

The Levers That Strengthen Retention

Retention improves when operations, product and timing align. The levers that consistently move the economics are:

1. Timing of the Next Purchase

The interval between the first and second purchase is often the strongest predictor of long-term value. Longer intervals weaken progression and slow payback.

2. Post-Purchase Experience

Clear expectation-setting, product usage guidance and reliable delivery heavily influence whether customers return.

3. Operational Reliability

Stockouts, fulfilment delays and support gaps erode repeat intent. Many retention issues originate here, not in marketing.

4. Category-Specific Repeat Behaviour

Different categories follow different natural repeat cycles. Aligning acquisition with categories that naturally drive repeat behaviour improves LTV and CAC tolerance.

5. Follow-Up Systems

Subtle, well-timed nudges move customers into the next logical step without relying on discounts or heavy incentives.

6. Refill and Subscription Paths

Refill or subscription models work only when aligned to actual usage patterns. When calibrated well, they stabilise repeat cycles and improve cash flow predictability.

Common Mistakes That Hurt Retention

Many brands weaken their own economics without realising it:

-

prioritising AOV at the expense of repeat behaviour

-

relying on discounts as the primary driver of second purchases

-

scaling acquisition before fixing retention fundamentals

-

ignoring marginal CAC behaviour as spend grows

-

treating retention as a siloed CRM activity

Retention is cross-functional. It sits across product, operations, support, experience and acquisition. When any one of these breaks, repeat behaviour breaks with it.

A Simple Retention Economics Heatmap

Use this structured view to identify where the economics are weakening:

| Area | What to Check | Healthy Indicator |

|---|---|---|

| Revenue Mix | New vs repeat revenue | Less than sixty percent new revenue |

| Cohort Curves | Purchase progression | Progression into three or more purchases |

| Payback | Months to recover CAC | Under six to nine months |

| Cash Cycle | Speed of cash return | Stable, predictable reinvestment cycles |

| Marginal CAC | CAC as spend scales | Gradual, manageable increase |

| Contribution Margin | Profit as scale increases | Stable or improving |

| Repeat Window | Time to next purchase | Within category norms |

This heatmap simplifies diagnosis and highlights where the system may be breaking.

The Economic Truth Most Teams Avoid

Retention does not replace acquisition. It makes acquisition scalable.

A brand with strong retention:

-

recovers CAC quickly

-

spends confidently

-

compounds through cohorts

-

absorbs rising CAC

-

maintains contribution margin

A brand with weak retention:

-

depends on new demand every month

-

experiences volatile CAC

-

slows reinvestment

-

hits ceilings long before the team expects it

The part most operators learn too late:

The strongest acquisition strategy in the world cannot outrun weak retention.

The weakest acquisition strategy in the world becomes unbeatable when retention is strong.

The real question is not whether you can acquire more customers. It is whether your economics allow you to keep acquiring them.

Retention is not a set of tactics. It is the economic infrastructure of a D2C business – the part that determines whether scale strengthens the model or quietly breaks it.